On March 6, 2024, the SEC issued a final rule requiring registrants to disclose climate-related information in their registration statements and annual reports. See additional details in the alert, SEC Finalizes Climate Disclosure Rule, published March 12, 2024.

Climate-related risks have financial consequences that investors in public companies consider when making investment and voting decisions. Driven by investor demand for consistent and comparable information regarding an issuer’s climate-related risks, the SEC issued proposed rule 33-11042, The Enhancement and Standardization of Climate-Related Disclosures for Investors.

The proposed rule would add Subpart 1500 to Regulation S-K, which would require both domestic and foreign registrants to disclose certain climate-related information in their registration statements and annual reports, including:

- Qualitative information about climate-related risks that are reasonably likely to have material impact on the business or consolidated financial statements

- Quantitative greenhouse gas (GHG) emissions metrics

The amendments would also add Article 14 of Regulation S-X that would require certain climate-related financial statement metrics and related disclosure to be included in a note to the audited financial statements.

Comments on the proposed rule are due May 20, 2022, or 30 days after publication in the Federal Register, whichever is later.

Proposed Climate-Related Information Disclosure Requirements

The SEC’s proposed climate disclosures are similar to those many companies already provide based on broadly accepted disclosure frameworks, such as the Task Force on Climate-Related Financial Disclosures and the Greenhouse Gas Protocol.

The proposed amendments to Regulation S-K would require disclosure, in registration statements and annual reports, about climate-related risks that are reasonably likely to have a material impact on a registrant’s business or financial statements over the short, medium, and long-term.

Registrants would be required to describe the actual and potential impacts of those risks on its strategy, business model, and outlook.

The term climate-related risks would be defined as the actual or potential negative impacts of climate-related events on a registrant’s financial statements—including severe weather events and other natural conditions, and transition activities.

In particular, the proposed disclosure requirements of domestic or foreign registrants include the following climate-related information:

- How any identified climate-related risks affected or are likely to affect the registrant’s strategy, business model, and outlook

- The oversight and governance of climate-related risks and relevant risk management processes, as well as management’s role in assessing and managing those risks

- Greenhouse gas (GHG) emissions, which, for accelerated and large accelerated filers and with respect to certain emissions, would be subject to assurance—as described in further detail below

- How any identified climate-related risks had or are likely to have a material impact on the business and financial statements

- Information about climate-related targets and goals, and transition plan, if any

- The parameters, assumptions, and projected financial impacts of the scenario analysis, if a scenario analysis is used to assess climate-related risks

- The price and rationale for selecting the internal carbon price, when an internal carbon price is used to assess climate-related factors

Greenhouse Gas Emissions

As noted above, under the proposed amendments to Regulation S-K, the required information about climate-related risks would also include disclosure of a registrant’s GHG emissions. Quantitative GHG emissions data can enable investors to assess a registrant’s exposure to climate-related risks—including regulatory, technological, and market risks driven by a transition to a lower-GHG intensive economy.

The proposed rules would define greenhouse gases as carbon dioxide, methane, nitrous oxide, nitrogen trifluoride, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride.

In particular, the proposed rules would require a registrant to disclose the following information on a disaggregated and aggregated basis:

- Scope 1 Emissions. Direct GHG emissions from operations.

- Scope 2 Emissions. Indirect GHG emissions from the generation of purchased or acquired electricity or other forms of energy that’s consumed by operations.

- Scope 3 Emissions. GHG emissions not otherwise included in the Scope 2 emissions that occur in the upstream or downstream activities related to operations, if material or if the registrant has set a GHG emissions target or goal that includes Scope 3 emissions.

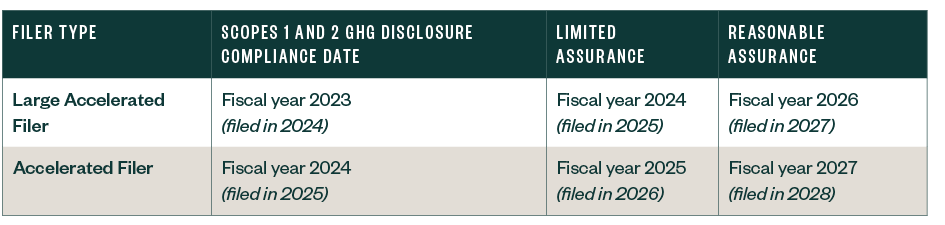

Accelerated filers and large accelerated filers would be required to include an attestation report from an independent attestation service provider covering Scopes 1 and 2 emissions disclosures.

However, an attestation service provider wouldn’t be required to be a registered public accounting firm.

Proposed Financial Statement Disclosure Requirements

The proposed amendments to Regulation S-X would require a registrant to include a new note to the audited financial statements providing disaggregated information about the impact of climate-related events and transition activities on the financial statements.

In particular, the proposed rules would require the following types of disclosures for climate-related events:

- Financial Impact Metrics. The individual financial statement line-item impact of severe weather events and other natural conditions, and transition activities when the aggregated impact is greater than one percent of the total line item.

- Expenditure Metrics: Total climate-related costs associated with the severe weather events and other natural conditions, and transition activities.

- Financial Estimates and Assumptions. The impact of the severe weather events and other natural conditions, and transition activities on the estimates and assumptions used in the financial statements.

The financial statement metrics would be subject to audit by an independent registered public accounting firm and within the scope of the registrant’s internal control over financial reporting.

What Would Be Required of a Domestic or Foreign Registrant

In summary, the proposed rules would require a registrant, including a foreign private issuer, to:

- Provide the climate-related disclosure in its registration statements and Exchange Act annual reports, for example on Form 10-K

- Provide the Regulation S-K mandated climate-related disclosure in a separate, appropriately captioned section of its registration statement or annual report

- Provide the Regulation S-X mandated climate-related financial statement metrics and related disclosure in a note to its consolidated financial statements

- Electronically tag both narrative and quantitative climate-related disclosures in Inline XBRL

- Obtain an attestation (assurance) report from an independent attestation service provider covering, at a minimum, Scope 1 and Scope 2 GHG emissions disclosure—if registrant is an accelerated or large accelerated filer

Phase-In Periods and Accommodations

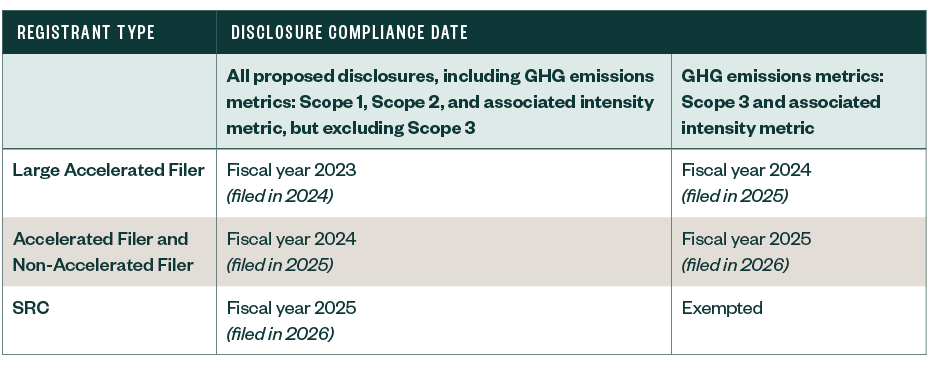

To promote the reliability of the climate-related disclosures for investors, the proposed rules would include a phase-in period for all registrants, including:

- A phase-in period for all registrants, with the compliance date dependent on the registrant’s filer status, and an additional phase-in period for Scope 3 emissions disclosure—refer to the Disclosure Compliance Dates by Registrant Type table below

- A phase-in period for the assurance requirement and the level of assurance required for accelerated filers and large accelerated filers—refer to the Table GHG Disclosure and Assurance Compliance Dates table below

- A safe harbor for liability for Scope 3 emissions disclosure

- An exemption from the Scope 3 emissions disclosure requirement for smaller reporting companies (SRCs)

- Forward-looking statement safe harbors pursuant to the Private Securities Litigation Reform Act, to the extent that proposed disclosures would include forward-looking statements

Disclosure Compliance Dates by Registrant Type*

GHG Disclosure and Assurance Compliance Dates*

*These tables assume that the effective date of the proposed rules occurs in December 2022, and that the registrant has a December 31 fiscal year-end.

We’re Here to Help

For more insight on what these proposed rule amendments could mean for your company, contact your Moss Adams professional.

You can also learn more about with our Environmental, Social & Governance Services.